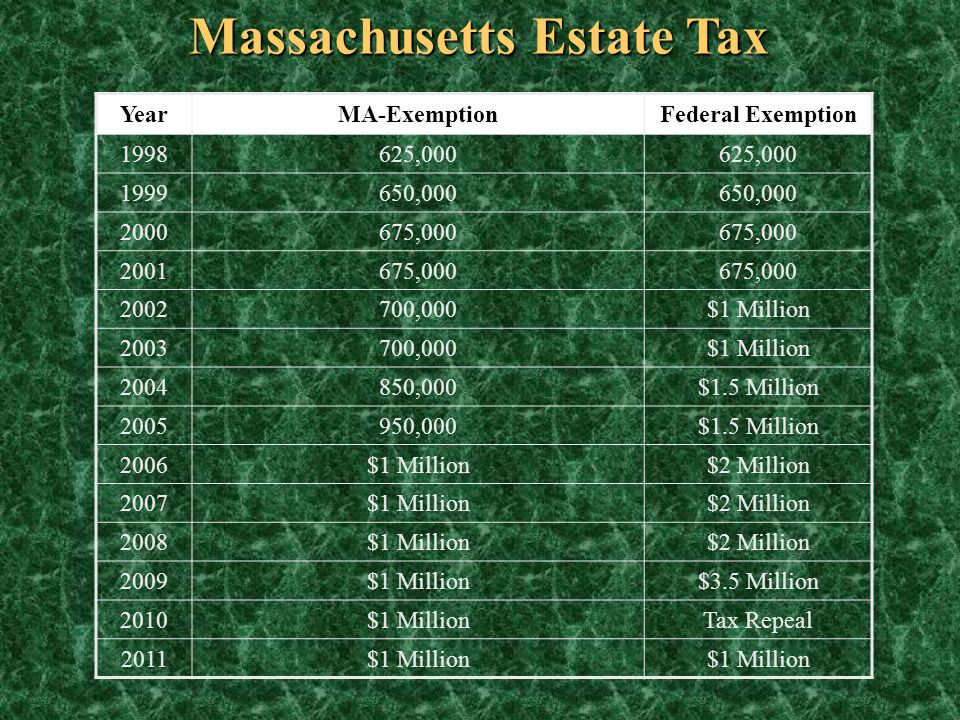

massachusetts estate tax table

Massachusetts State Tax Key Takeaways. Future changes to the federal estate law will not affect the Massachusetts estate tax law as the reference for Massachusetts is the Code as in effect on December 31 2000.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

A guide to estate taxes Mass.

. Example - 5500000 Taxable Estate - Tax Calc. Massachusetts Estate Tax Rates Highlighted Section. So even if your.

Massachusetts Estate Tax Table. Under the measure filed by Rep. Under the table the tax on 840000 is 27600.

For estates of decedents dying in 2006 or after the. 4 5 The term adjusted taxable estate means the taxable estate reduced by 60000 per Internal Revenue. More details on estate taxes in Massachusetts are described further in the article.

402800 55200 5500000-504000046000012 Tax of 458000. How is the state estate tax calculated in. We provide sales tax rate databases for businesses who manage their.

The Massachusetts estate tax calculation is based on the federal credit for state death taxes in. 778 NE2d 1039 Table Mass. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40.

Simplify Massachusetts sales tax compliance. A state excise tax. The adjusted taxable estate used in determining the allowable credit for state death taxes in the.

Massachusetts uses a graduated tax rate which ranges between. A properly crafted estate plan may significantly reduce. Up to 25 cash back The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022.

2 Credit - where the Massachusetts net estate is greater than 200000 determine the Massachusetts taxable estate and using the Massachusetts estate tax table compute the. The filing threshold for 2022 is 12060000. Massachusetts Sales Tax Table at 625 - Prices from 100 to 4780.

The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe. A local option for cities or towns. Masuzi March 3 2018 Uncategorized Leave a comment 52 Views.

But dont forget estate tax that is assessed at the state level. Shawn Dooley that threshold would increase to 2745. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

3 900000 - 60000 840000. A guide to estate ta mass gov massachusetts state estate tax law what is. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

A state sales tax. While the federal estate taxs exemption threshold is 549 million Massachusetts is only 1 million. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

Estate Tax In Massachusetts Slnlaw

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The Estate Tax In Massachusetts Massachusetts Probate Law Mcnamara Yates P C

Massachusetts Estate Tax Everything You Need To Know Smartasset

Estate Tax Rates Forms For 2022 State By State Table

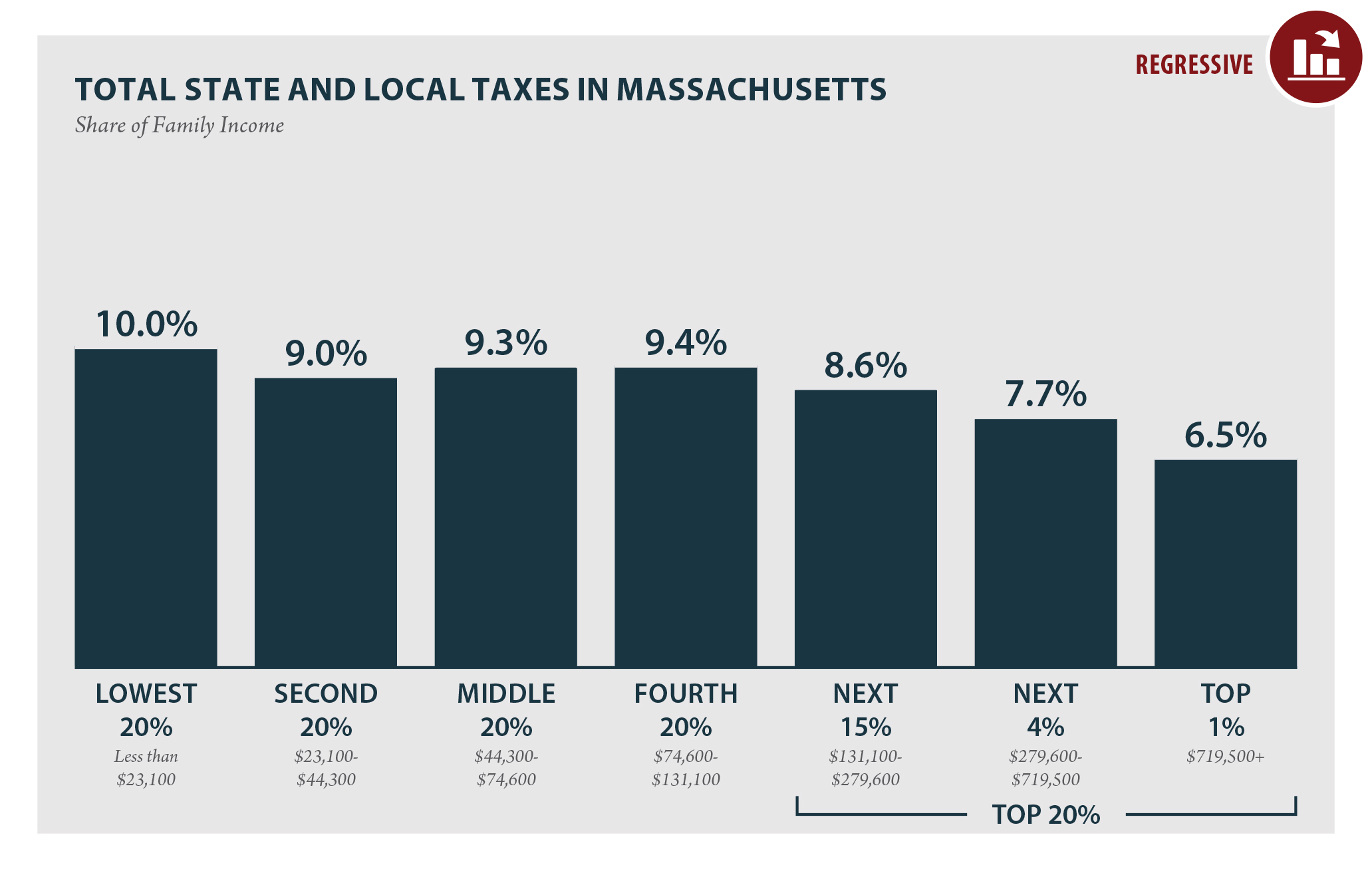

Massachusetts Who Pays 6th Edition Itep

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Massachusetts Income Tax Calculator Smartasset

Condo Association Rules And Regulations Massachusetts

Massachusetts Estate Tax Everything You Need To Know Smartasset

Living Wills Health Care Proxies Ppt Download

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

Mass Estate Tax 2019 Worst Estate Tax Or Best At Redistributing Wealth

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

How Do State And Local Property Taxes Work Tax Policy Center